The “Art of the Don Con” here

from CNN with this headline:

“Trump SPAC skyrockets as much as

1,657% since deal was announced”

Trump's planned return to Wall Street is setting off a

frenzy.

Shares of the shell company that Trump's new media company (TMTG:

Trump Media & Technology Group) plans to merge with surged as much as

284% on Friday, prompting a series of trading halts for volatility.

That is Digital World Acquisition Corp., (DWAC) finished the day up 107%.

At its peak of $175.00

per share on Friday, the Nasdaq-listed company was a staggering 1,657% above

its Wednesday closing price.

Trump announced Wednesday that his TMTG is also known as a SPAC (Special Purpose Acquisition Company).

The new Trump entity merger with DWAC closed at $9.96 on

Wednesday – quadrupled on Thursday – then climbed to $131.90 by Friday.

Matt Kennedy, senior

IPO market strategist at Renaissance Capital said: “This is extremely

unusual, especially now. We saw significant pops during the height of the SPAC

bubble. Nowadays it's rare to see a SPAC pop more than 10%.” Kenney then warned

investors that $10 should be looked at as the floor for this stock. This is

clearly meme stock territory. It's totally disconnected from fundamentals.

There are no known fundamentals. Be prepared to lose potentially everything else.

This is a stock trading purely on momentum.”

Normally, SPAC merger announcements contain financial projections and details on the capital structure. In this case, there was merely a press release and an investor presentation that contained no estimates on how much money the company could bring in.

The Trump SPAC is attracting interest from traders at Wall Street Bets, according to Swaggy Stocks, which tracks mentions on the Reddit page.

FYI: Wall Street Bets is the Reddit group at the heart of the Games Stop saga earlier this year.

The bonanza comes despite the fact that the

latest filings do not indicate how much revenue — if any — TMTG generates. It's

likely to be minimal, given that the firm's social media platform has not

launched yet.

Plus, Trump's businesses have a long history of filing for bankruptcy, e.g., Trump previously

filed for four business bankruptcies, all focused on the casinos he used to own

in Atlantic City, NJ.

The last Trump IPO occurred in 1995 when he brought Trump

Hotels & Casino Resorts public. That casino posted losses every year it was public, and a decade later,

it filed for bankruptcy.

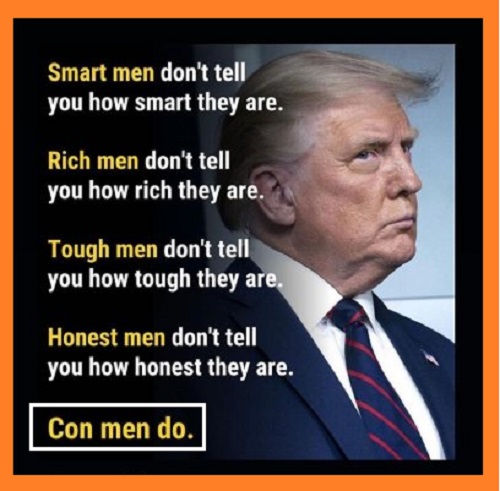

My 2 Cents: The lesson

here is simple – trust or believe Trump at your own peril.

Fact: Everything Trump touches basically turns to sh*t — yet, he still walks away bragging how much money he has and that keeps his con alive.

Just like now with his “Big Lie” about the 2020 election that he pitches in every speech he makes just to rake in more money and supporters.

That is his skill: Being a masterful con artist.

Now he’s trying to bring in massive capital to buy the United States of America and rename it the United States of Trump – bet on it.

But, if you do bet on it – plan on losing our past, the present, and our future along with every shirt we own as a proud nation that is now 245 years old.

Thanks for stopping by.

No comments:

Post a Comment